AML Compliance Simplified

“Navigating AML can be frustrating for accountants. That’s why we built Firmcheck, to simplify compliance by removing the manual work.”

Hamish Edwards, co-founder of Xero and Firmcheck.

Trusted by

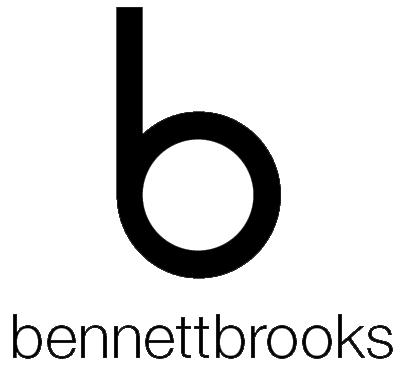

Your AML compliance

AML compliance is more than ID checks, but it doesn’t have to be complicated. Firmcheck makes the requirements for your firm and your clients crystal clear, so you can stay compliant with confidence.

Your AML time saver

Save time on compliance without cutting corners. Firmcheck streamlines onboarding, verification, and monitoring so your team can focus on clients, not paperwork.

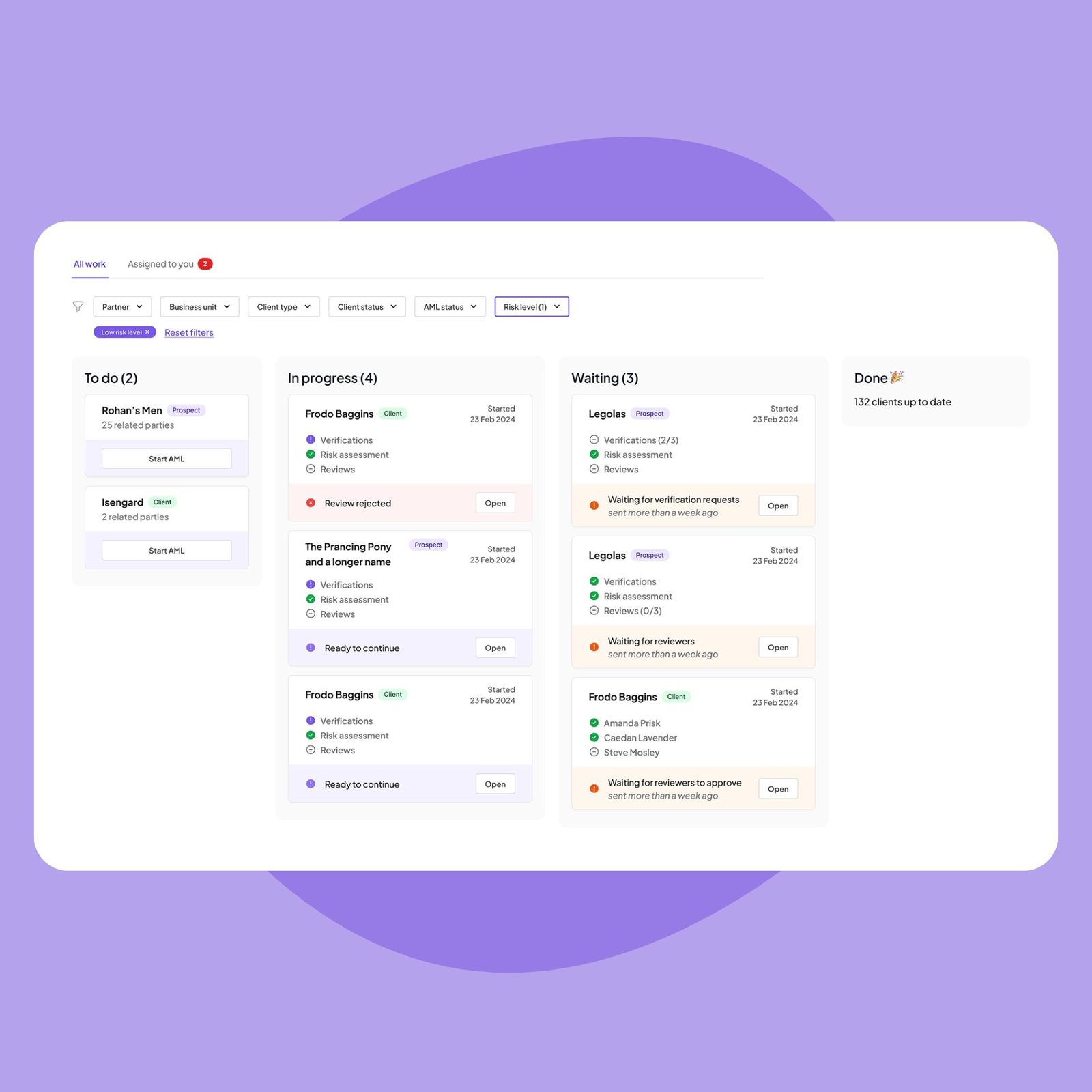

Your AML control centre

See every AML gap and track your team’s progress in one place. Firmcheck gives you full visibility and control in a single solution.

Your AML support partner

From managing your data during onboarding to having AML experts handle complex cases, Firmcheck supports you every step of the way.

Free AML Education

Complete your annual AML requirement with our in-app education.

Risk Assessments

Risk assessments help you decide how much due diligence to apply

AML Red Flags

Submitting a Suspicious Activity Report (SAR) is a legal obligation under UK AML laws.

AML Essentials

If AML feels overly complex, this guidance is designed to help you get to grips with the essentials

Customer testimonials

Firmcheck has transformed our compliance processes.

Get On The Path to Compliance In Hours

Firmcheck is designed to make your life easier from onboarding through to ongoing monitoring. We focus on building time-saving features that reduce the effort required to stay compliant.

Bulk Document Import

Tasks that take others months to complete, done in hours with Firmcheck.

Bulk ID verification

Review your AML gaps after the bulk import and enable bulk ID verification and Ongoing Monitoring.

Try Firmcheck

for free

Start your compliance journey for free. Try Firmcheck's beautifully designed platform and see why firms trust us with their AML compliance.